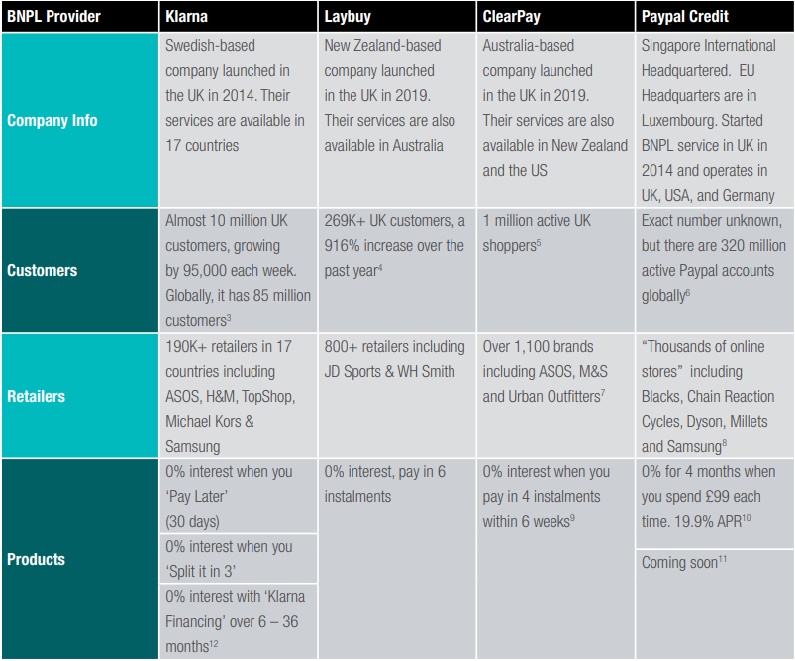

Buy Now Pay Later (BNPL) has quickly risen to prominence in the UK in the last decade, with Swedish challenger bank Klarna, which arrived in the UK in 2014, spearheading this exciting new form of credit. BNPL provider’s partner with retailers to give consumers the option of upfront credit which can be paid at a later date, either via a deferred payment in full or by splitting the payment across multiple fixed installments with any interest agreed upfront and built into the repayment plan. The rise in BNPL services has predominantly come around thanks to a series of fintechs coming to the table as payment platforms and partnering with leading e-commerce retailers to offer interest free credit at checkout. According to a 2020 Worldpay report, BNPL fintechs are growing at a rate of 39 percent annually in the UK, with expectation that they will double their ecommerce market share by 2023.

Slow to the digital field in general; Pakistan’s e-commerce marketplace has hit a major growth spurt in 2020 and 2021, with revenue growing by over 35 percent in the first quarter of the fiscal year 2021 alone. It is also a younger demographic: 40 percent of the population is under the age of 30. Also, the increased access to digitization – even rural areas have 3G at this point – has served to give commerce a massive shove forward.

Where does BNPL fit in the wider consumer credit industry?

BNPL is a ‘during purchase’ payment option which is predominantly present in ecommerce, although there have been products launched for face-to-face point of sale (PoS) transactions, such as Klarna In-store (by QR code), Klarna Card and Laybuy. Other consumer credit options include PoS finance, and revolving credit cards. PoS finance is typically initiated in-store when purchasing electronics and household goods, and such solutions have historically had socioeconomic status around them. The revolving credit card is perhaps most under threat from BNPL, although our Capco research shows that credit cards are here to stay for the time being.

However, what Pakistan is lacking, QisstPay Co-founder Jordan Olivas told Karen Webster in a recent conversation, is an easy way to access credit. Credit card penetration is low, and cash remains king when it comes to making payments. The market clearly needs another option, which is what Pakistani version of BNPL aims to offer as it introduces buy now, pay later (BNPL) as a tool to the Pakistani market.

“The problem in Pakistan today is that there aren’t a lot of ways to get formal credit,” noted Olivas. “So this is something very specific. We are not offering lines of credit. We’re not issuing loans. What we are doing is factoring invoices, in a sense. We’re essentially buying the invoice from the merchant and extending a partial net 30 to the consumer.”

As a result, the consumer gets a chance to split up their payments – paying 50 percent at the time of purchase and the other half 30 days later. That payment cycle was chosen to match up with typical Pakistani pay cycles, which are usually 30 days.

Like QisstPay, a conventional buy now pay later (BNPL) credit facility initiative; KalPay is a Shariah Compliant Buy now Pay later service. It allows customers to use credit and payback in installments or delay their payments.

WHAT IS THE CUSTOMER NEED?

The growth of digital wallets and mobile commerce will be at the forefront of future BNPL adoption, given the younger demographic focus and personalized user experience already available on BNPL apps. During the 2019 holiday season in Australia, Afterpay reportedly saw 80 percent of all their customer base using their mobile phones to BNPL, proving that convenience is still king, this can be validated through a Market Research.

Market research should never be underestimated. Many successful new businesses enjoy longevity because their owners conduct regular market research to understand their target market, identify consumer problems and pinpoint realistic competitors. In Pakistan, companies undermine the long term benefits of market research. Least weightage is assigned to market research when deciding relevant markets for products and services. Companies do have provision for market research but are reluctant to invest in getting a real-time market assessment and as a result, often their strategies and policies are ineffective in capturing a true market share of forecasted targets. This leads to inconsistency in growth, earning and customer retention in the longer run.

Market Research is the simplest way for entrepreneurs to keep up with market trends such as, BNPL and maintain a competitive edge by sizing up your business opportunity.

Market research can be carried out at various stages of a business life cycle, from pre-launch and beyond. Having a greater understanding of your marketplace from the very start will enable you to create a sound business strategy to establish and grow your brand into one that’s better than the competition.

Ace Research is one of the leading market research and customer experience management companies in Pakistan with a team dedicated to helping the client get the insights that they desire. Our years of experience speak of our keen analysis of customer preference and nevertheless, approach to identify and materialize market opportunity. Our team has an eye upon all the latest market trends and at the moment it is BNPL.

Market Research ‘Assessing BNPL need from the customer’s perspective’

- It helps new startup BNPL businesses strengthen their position

- It minimizes any investment risk involved in exploring new opportunities.

- It identifies potential threats and opportunities for BNPL companies

- It helps to discover yours and your competitor’s strengths and weaknesses, n this context other local and regional competitors

- It facilitates strategic planning

- It assists businesses to stay ahead of the competition

- It provides revenue projections

- It focuses on customer needs and demands, the foremost important need for new BNPL startups

- Identifies Target Audience ‘Core Essential for Business Growth’

- It helps to evaluate the success of business against benchmarks

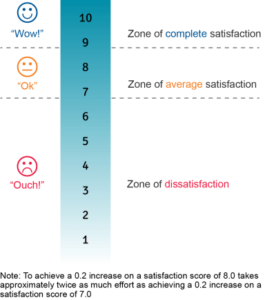

An International survey found that companies that benchmark achieve 69% faster growth and 45% greater productivity than those that don’t. Use market research to analyze competitors, employee engagement surveys and to highlight performance or knowledge gaps and areas for potential growth. This will open your company up to thinking about new methods, ideas, and tools to improve your business effectiveness.

WHO IS BNPL FOR?

Buy Now Pay Later has been stereotyped as a solution for people who live paycheck to paycheck, however, a series of consumer research carried out by multiple different sources has identified that it is in fact simply a great solution for the budget conscious and more ‘credit averse’ consumers. Indeed, our consumer research survey on BNPL found that almost 30 percent of BNPL users were well above the average UK individual annual income.

Furthermore, our consumer research indicated that consumers like the concept of BNPL as it gives them the flexibility to manage their finances, regardless of income level. For the majority of those who have used BNPL before, they even prefer it to other forms of credit, like credit cards or store cards20. At present, BNPL purchases are clustered around typically cheaper retail items but there is a clear appetite to pay for more expensive items using BNPL too.

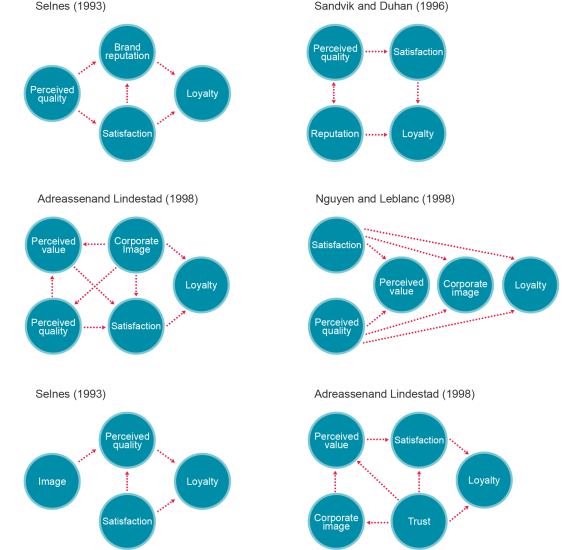

TRUST & LOYALTY

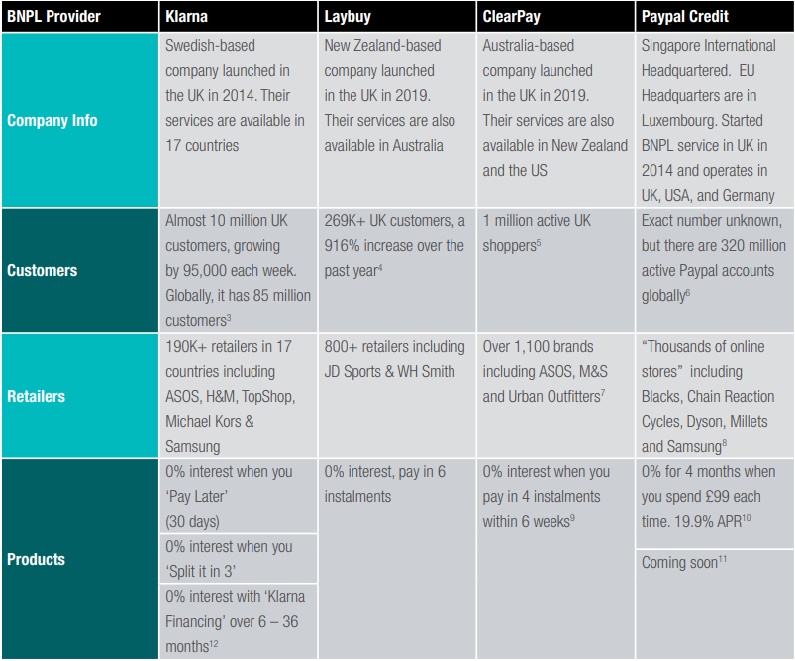

To date, how a consumer selects a BNPL option has been driven by the merchants they shop with. Strong partnerships with a broad range of merchants enable Klarna, ClearPay, LayBuy and PayPal Credit to shape the UK’s BNPL and consumer credit markets. The branding of these BNPLs are also very much present on social media channels, and even Transport for London advertising spaces, such as on the tube and on sides of London buses. This begs the question; does the same amount of thought go into selecting a BNPL provider as you would with choosing a new bank? Loyalty plays a big role in consumer behaviors, but whether the BNPL era is driving loyalty amongst consumer’s remains to be seen. After that first purchase with a BNPL provider, does the consumer become more attached and loyal to that brand, or would they ‘cheat on them’ for their next BNPL transaction? We don’t know the answer to this exactly, but we do know that one of the biggest issues online retailers face is the dreaded shopping basket paralysis.

A CHANGING ATTITUDE TOWARDS CREDIT

The presence of BNPL providers is playing a key role in changing the buying behaviors and general outlook on traditional methods of credit. Our research shows, contrary to the youthful marketing image of BNPL, the biggest users of BNPL are in fact 35 – 44-year-olds (Gen Y and X demographics), followed by the over 65s (Boomers) according to our research26, which suggests more mature demographics are not averse to trying new types of credit; and as aforementioned, BNPL is the most preferable form of credit for those who have used it to make a payment before.

By providing a manageable way for consumers to borrow and repay with the interest (where applicable) built into the repayment plan with fixed-end date, BNPL providers are giving consumers more assurance that they can repay without falling into a revolving credit repayment.

IMPLICATIONS FOR BANKS AND CREDIT CARD ISSUERS

The rise of BNPL services demonstrates the need for banks and credit card issuers to act quickly in response to this demand for change. Unsecured credit is transforming, and credit card issuers need to consider new ways of offering credit to consumers; furthermore, with the cost of credit reportedly rising27, customers may be driven towards alternative lending solutions sooner rather than later. Banks have been considered a trusted source of lending, so it seems like a no-brainer to give customers the choice to pay by instalments. This would additionally give customers a tool within their existing safe and trusted banking space to manage their finances, avoiding taking on additional apps and new lenders. Almost half of our surveyed BNPL users would like this service (45 percent) from their bank or credit card provider28. We believe banks should be making a defensive ‘play’ in this space to maintain their existing market share by:

- Looking at investing in installments solutions

- Creating their own standalone BNPL products

- Partnering with a BNPL provider to provide either of the above.

Big Untapped Opportunity Lies Ahead

Banks with existing merchant relationships may have a competitive edge in entering the BNPL space. If they’re already partnering with merchants with credit card or other private-label credit card or other financial products, they’re really well positioned. This opportunity is wide open to all banks in Pakistan.

While there is much to be said for being the first player out on a greenfield – as QisstPay is in Pakistan – there is the massive challenge of getting both consumers and merchants on board and willing to use something new. While services like Afterpay might see their most avid users tapping into the service five or six times a month, a QisstPay superuser might use the platform once or twice.

But company management believes, they will see that change over time, particularly as they are able to recruit more merchants onto the platform, and as the new payment form becomes more familiar to customers. This has been the pattern as BNPL platforms have emerged elsewhere in the world.